2016 April New MB6-702 Exam Questions and Answers Released Today!

2016 New MB6-702 Study Guides:

Configure Microsoft Dynamics AX 2012 R3

Manage Microsoft Dynamics AX 2012 R3

Define and manage budgets

Configure and manage Fixed Assets

QUESTION 1

You are the Microsoft Dynamics AX administrator for an organization.

The organization has a maximum cash credit limit of $20,000.

If a payment is issued for more than the stated cash credit limit, the payment is rejected and the organization is fined.

You need to ensure that payments do NOT exceed the cash credit limit.

Which two actions should you perform? Each correct answer presents part of the solution.

A. On the Bank accounts form, enter the Credit limit value.

B. On the Bank accounts form, set the Bank account status option to Inactive for all transactions.

C. On the Bank accounts form, enter the Active from and Active to dates.

D. On the Cash and bank management parameters form, set the Bank credit limit tolerance

option to Error.

Answer: AD

Explanation:

A: Field: Credit limit

Enter the credit limit for the bank. You must enter a negative amount in this field.

You are notified if the bank balance exceeds this limit when you post a payment journal.

D: Field: Bank credit limit tolerance

Select how to notify the user when a payment journal that is posted causes a balance to exceed the credit limit. Select from the following options:

* None ¬ Do not consider the credit limit.

* Warning ¬ Display a warning when the credit limit is exceeded, but continue the process.

* Error ¬ Display an error when the credit limit is exceeded, and stop the process.

QUESTION 2

Your company uses two-way matching to create vendor invoices.

Which elements are used in the two-way matching process?

A. Quantity received and quantity invoiced

B. Price information on the invoice and price information on the purchase order

C. Invoice total amount and the total amount on the purchase order

D. Quantity ordered on the purchase order and quantity invoiced

Answer: B

Explanation:

Two-way matching ¬Match the price information on the invoice to the price information on the purchase order.

QUESTION 3

You need to revaluetheforeign currency transactions in the Accounts payable subledger.

Which two statements describe what the foreign currency revaluation job accomplishes? Each correct answer presents a complete solution.

A. Settled vendor transactions are revalued by using the effective exchange rate for the specified date.

B. Open vendor transactions are revalued by using the effective exchange rate for the specified

date.

C. The differences between the original posted amounts and the revalued amounts are posted to vendor accounts as unrealized transactions.

D. The differences between the original posted amounts and the revalued amounts are posted to vendor accounts as realized transactions.

Answer: BC

Explanation:

B (not A): The job uses a new exchange rate to revalue the amounts that were open, or not settled, on a specified date.

C: The differences between the original posted amounts and the revalued amounts are posted to the ledger. The differences are also posted to vendor accounts as unrealized transactions of the foreign currency revaluation

QUESTION 4

You need to set up the posting profile for realized and unrealized gains and losses.

Which two forms should you use? Each correct answer presents a complete solution.

A. Chart of accounts form

B. Currency revaluation accounts form

C. Currency exchange rates form

D. Ledger form

Answer: BD

Explanation:

B: Currency revaluation accounts, where you identify the relevant account for realized gain, and loss, unrealized gain, and loss.

D: General Ledger

. We have also seen issues with the Gain and Loss accounts. a. General Ledger>>Setup>>Ledger ¬ Verify there is a Main account setup for the Realized and

Unrealized Gains and Loss records.

QUESTION 5

You select Business unit and Department as the only financial dimensions to use with budget control.

You need to prevent a budget overrun on all direct expense accounts.

What should you do?

A. Select the accounting journals that are subject to budget control.

B. Define the over budget permissions for user groups in the budget control configuration.

C. Select the source documents that are subject to budget control.

D. Define the main accounts to use for budget checking in the budget control configuration.

Answer: C

Explanation:

Select source documents for budget control

In the Select source documents area, you can select check boxes to determine the source documents that are subject to budget control. You can also select check boxes to enable budget checks as the lines for source documents are entered and saved.

QUESTION 6

Your company plans to implement vendor invoice matching.

Your company policy states that vendor invoices must be reviewed to compare the prices and quantities on the invoices for accuracy.

You need to configure the invoice matching setup.

Which type of invoice matching should you configure?

A. Charges matching

B. Three-way matching

C. Invoice totals matching

D. Two-way matching

Answer: B

Explanation:

Three-way matching ¬ Match the price information on the invoice to the price information on the purchase order. Also match the quantity information on the invoice to the quantity information on the product receipts that are selected for the invoice.

Incorrect:

Not A: Charges matching ¬ Match the charges information (amounts) on the invoice to the charges information (amounts) on the purchase order. Not C: Invoice totals matching ¬ Match the total amounts on the invoice to the total amounts on the purchase order. This type of invoice matching includes the least amount of detail, so you can use this option to set up controls that minimize the staff time that is required to review invoice matching information.

Not D: Two-way matching ¬ Match the price information on the invoice to the price information on the purchase order.

QUESTION 7

You need to configure a workflow to approve all budget amounts at the line level.

Which workflow configuration type should you use?

A. Budget register entry workflow

B. Ledger fixed assets budget journal workflow

C. Budget plan workflows

D. Budget account entry workflow

Answer: D

Explanation:

If the budget account entry lines require different workflow approvals, you must use a Budget account entry workflow to create different workflow configurations. For example, you might use one Budget account entry workflow configuration to review and approve a high amount, and another Budget account entry workflow configuration to review and approve a low amount.

QUESTION 8

Which three objects can be used to define fixed asset posting profiles? Each correct answer presents part of the solution.

A. Asset type

B. Fixed asset group

C. Asset activity code

D. Transaction type

E. Value model

Answer: BDE

Explanation:

Create or view the parameter combinations that determine which accounts the fixed asset transactions will be posted to if they are assigned the selected posting profile.

The key parameters are as follows:

* The value in the Groupings field, by which you can set up one posting profile for all fixed assets, one for each fixed asset group, or one for each or a particular fixed asset.

* The fixed asset transaction type.

* The value model used.

QUESTION 9

You apply a customer payment.

The payment amount is less than the amount of the invoice.

What are two results of this payment? Each correct answer presents part of the solution.

A. The payment remains open for the amount of the difference between the payment and the

invoice.

B. The invoice remains open for the amount of the difference between the payment and the

invoice.

C. The payment is settled and closed.

D. The invoice is settled and closed.

Answer: BC

Explanation:

If the payment amount is less than the amount due, the payment amount is subtracted from the amount due, and the invoice remains open. The payment transaction is fully settled and is closed.

QUESTION 10

You are configuring Microsoft Dynamics AX for basic budgeting.

Which two setups are optional? Each correct answer represents a complete solution.

A. Reason codes

B. Workflows

C. Budget models

D. Journal names

E. Budget codes

Answer: AD

Explanation:

Not C: The names of each budget model

Not E: The budget codes that must be set up for each budget type, and which code is the default budget code

Not B: You assign workflows to budget codes. The budget register entries that are associated with a budget code that has an assigned workflow are automatically submitted to workflow.

Note: Basic budgeting includes financial dimensions that are defined for Budgeting, budget register entries, and Budgeting workflows.

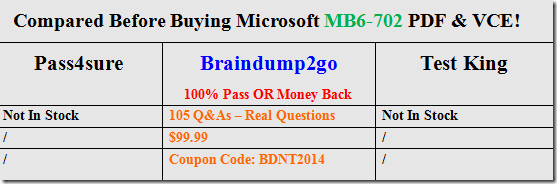

2016 NEW MB6-702 Exam PDF and VCE Dumps 105q Full Version from Braindump2go:http://www.braindump2go.com/mb6-702.html